This is probably one of the most talked about news of the week as we are hit by afew new cooling measures on the midnight of 29th September

Without further ado I'll like to share the gist and summary of some of the cooling measures implemented and be talking more about them below.

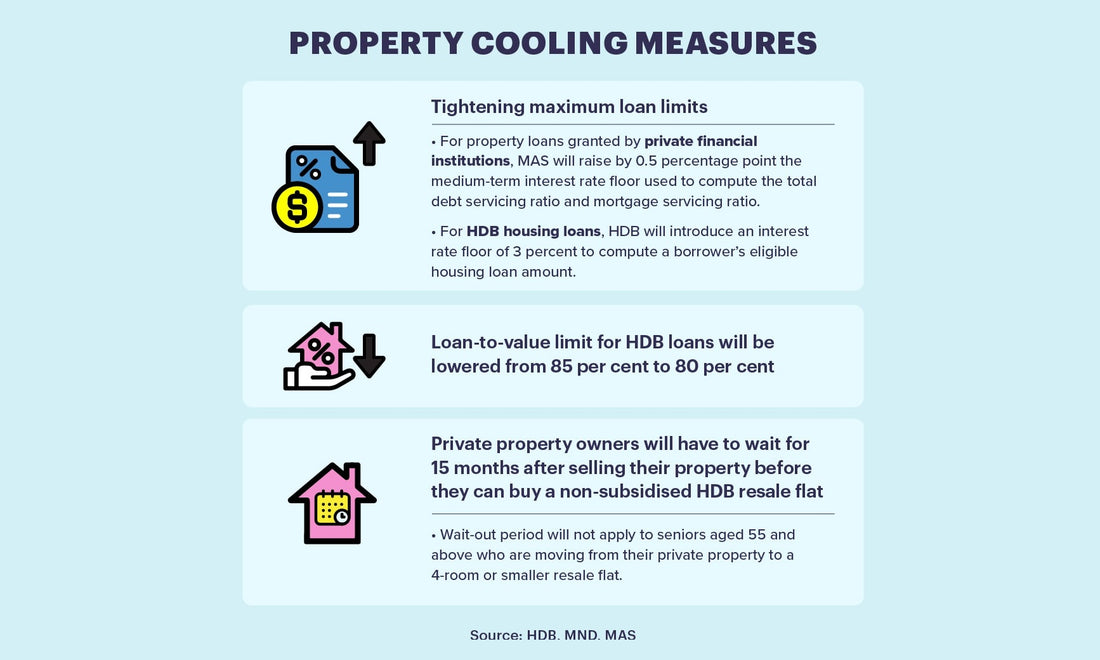

Highlights:

- LTV limit for HDB loans will be lowered from 85 to 80 per cent

- Raising medium-term interest rate floor used to compute TDSR and MSR by 0.5 per cent

- Interest rate floor of 3 per cent for computing eligible loan amount for those granted by HDB

- 15-month wait-out period for private home owners buying HDB

Instead of using the 3.5%, calculation for TDSR & MSR will increased byt 0.5% to 4% to ensure prudent borrowing and moderating demands.

Pre-Emptive measure as Federal Open Market Committee (FOMC) is expected to increase another 125 basis points to move Fed Fund Rates from 3-3.25% to 4.25-4.5%

As our bank interest rates move according to the Fed's rate, this is also to prep homebuyers who are looking to take on loans in the future and also to create a better "safety" net and prudency, for increasing interest rate.

Usually 90% of buyers don’t stretch all the way to max purchase price, and hence this will not have a drastic impact on buyer’s eligibility.

Impact Level: ★★☆☆☆

Reduced Loan-to-Value (LTV) limit for HDB granted laons from 85% to 80% for HDB loans

Similar to the previous cooling meaures earlier (adjusting from 90% to 85%), this is almost as good as normalizing HDB's LTV reasure to private property's 75% LTV. This would also reduce the loan quantum available, and homebuyers now need more cash and CPF on hand to purchase

For HDB loan, they would also be using a new interest floor rates of 3% for calculation.

This would only apply to new applications for HDB HLE from 30th September 2022 onwards. This does nto affect the actual HDB interest rate (which is still 2.6% for now) this rate would remain at 2.6% till 31 December 2022.

Impact Level: ★★☆☆☆

15-Month Wait-out Period for private Home owners buying HDB Flats

55 Years-Old Buyers can buy 4-Room and Smaller without 15 months waiting period. This measure is mostly for homebuyers who intend to cash out, to buy a bigger HDB unit and by doing this this would deter speculation/driving the price up. This wait out period would definitely affect downgrader's plan, and intended to cool off demand for the resale flat markets as we are seeing million dollar transactions for HDB Flats

This is however a temporary measure that will be reviewed.

Impact Level: ★★★★☆

All in all, with US central bank already announcing that they are not done with increasing the interest rates, we could see MAS potentially increasing the TDSR interest rate to 4.5% by end 2022.

The barrier to entry is getting higher with time, and your age is also reducing your loan tenure. But there is still opportunity to enter the property market!

Some other key pointers to share:

- Do we expect demand or prices to fall? Price No, Demand Yes.

- When homebuyers decided to hold back their purchases, developers might hold back, home buyers might also not intend to sell their property current and everything would be on hold

- Transaction in the next few months can expected to be low

- Impact on prices might not be much as demand still hold out strong; most projects in the market are 50-90% sold HDB demand remains high as well

Feel free to reach out if you'll like a more comprehensive advise and how can you move forward from here!

Some sources to read: