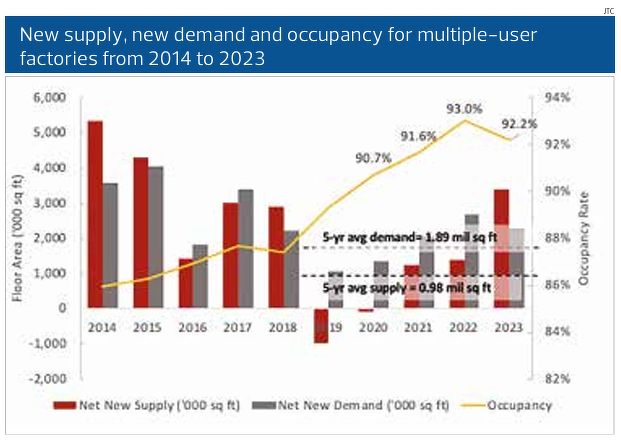

In Singapore's industrial sector, multi-user factories have witnessed a robust rental growth of 10.7% year-on-year in 2023, propelled by the introduction of newer and strategically located properties, according to JTC's 4Q2023 industrial report. The occupancy rate for multi-user factory developments stood at a commendable 92.2% by the end of last year. ERA Singapore's director of capital markets and investment sales, Pearl Lok, forecasts industrial prices to grow between 3% and 5% year-on-year in 2024, driven mainly by multi-user factories and warehouses, particularly in prime locations. Lok also expects rental growth to mirror price growth, ranging from 3% to 5% in 2024, albeit at a slower pace compared to the previous year's surge.

The slower pace of rental growth in the multi-user factory segment for the current year can be attributed to the influx of 2.4 million square feet of new supply entering the market. Notable upcoming developments set for completion in 2024 include JTC Bulim Square and One KA@MacPherson. With total available industrial stock standing at 52.9 million square meters, ERA highlights that the majority of future supply comprises single-user space with short lease tenures, making freehold industrial spaces a rarity in Singapore.

One such rare freehold industrial space is the CT FoodNex Hub at Mandai Estate, developed by Chiu Teng Group. Since its launch in May 2023, approximately 73% of the industrial units at CT FoodNex have already been taken up, signaling strong investor interest. With its strategic location along the main road and proximity to the Johor customs, CT FoodNex remains an attractive investment opportunity.

Demand for food factories is expected to continue rising, driven by factors such as the growth of the food delivery business and increasing demand for food processing, cloud kitchens, food packaging, and cold storage rooms. The government's push for more food facilities aligns with its "30 by 30" goal to achieve food security by producing 30% of the nation's nutritional needs by 2030. Initiatives like the Sungei Kadut Eco-District manufacturing estate and the Northern Agri-Tech and Food Corridor further support this objective.

In conclusion, the industrial sector, particularly multi-user factories and food factories, presents promising opportunities for investors seeking alternative investments. With rising demand and government support for the food industry, food factories emerge as a lucrative choice in Singapore's evolving investment landscape.

Source: EdgeProp