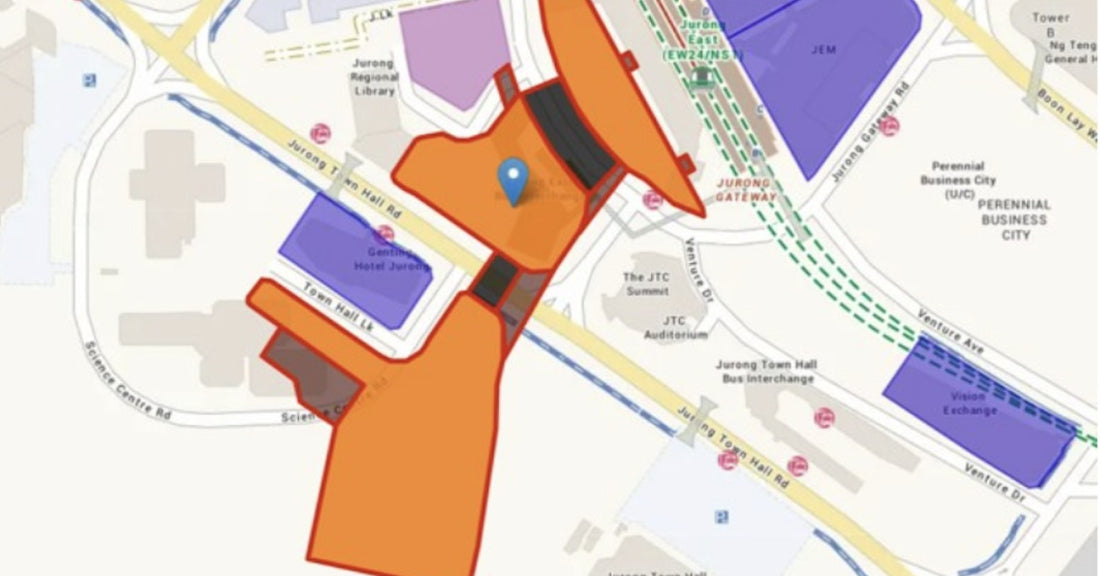

The recent announcement by the Urban Redevelopment Authority (URA) regarding the Jurong Lake District (JLD) master developer site not being awarded has created a stir in the Singapore property market. The site, launched for sale on June 22, 2023, was intended to act as a key driver of development in the Jurong region, further establishing the area as the country’s largest commercial hub outside the Central Business District (CBD). However, after receiving only one bid, the URA decided not to proceed with the sale due to the bid price being deemed too low at $640 per square foot per plot ratio (psf ppr).

Bid Deemed Too Low

The sole bid, from a consortium comprising CapitaLand, City Developments Ltd (CDL), Frasers Property, Mitsubishi Estate, and Mitsui Fudosan, fell short of the government’s expectations. At $640 psf ppr, the price was seen as insufficient, especially considering the strategic importance of the Jurong Lake District, which is intended to yield over 1.6 million square feet of office space, 1,760 private residential units, and nearly 807,300 square feet for retail, hotel, or community uses.

Historical data shows that land prices in the area had previously reached higher levels. For example, the Boon Lay Way site (Westgate) was sold for $1,012 psf ppr in 2011, and the Jurong Gateway Road site (JEM) fetched nearly $650 psf ppr in 2010. In this context, the $640 psf ppr bid appears conservative.

Developers’ Cautious Approach

The decision to submit a lower bid might reflect developers’ concerns about market risks. High financing costs, uncertain demand for office space, and the sheer scale of the development could have prompted a more conservative bid. Additionally, the pandemic’s long-term effects on the demand for commercial and office space have added uncertainty. Mark Yip, CEO of Huttons Asia, highlighted that the market is still undergoing a post-pandemic adjustment phase, which is likely influencing developers’ investment appetite.

Moreover, the large size of the development means that any successful bidder would need to be prepared for a long gestation period to recover costs. Developers were also required to include urban solutions like a district cooling system and a pneumatic waste conveyancing system—factors that would have added to the costs and risks.

Medium-Term Market Relief

Tricia Song, CBRE's head of research for Southeast Asia, mentioned that the decision not to award the site could provide a “medium-term relief” to the island-wide office supply, as the 0.7 million sq ft of potential office space will be delayed beyond 2030. This gives developers time to adjust to market conditions before committing to such a massive project.

However, the URA remains committed to the long-term vision for Jurong Lake District, signaling that the government has not abandoned its ambitious plans for the area. The site will now be placed on the Reserve List, allowing the government to reassess the market and adjust the price expectations accordingly.

Outlook for Buyers and Investors

For buyers and investors, the JLD still holds significant potential. With new developments like J'den by CapitaLand, which sold 88% of its 368 units on launch day in 2023, the region continues to attract strong interest. Similarly, projects like The LakeGarden Residences have shown promising sales, with 57% of units sold at an average price of $2,155 psf.

Despite the pause on the master developer site, Jurong Lake District remains a vibrant, upcoming area for property buyers. With its excellent connectivity, proximity to amenities like the Singapore Science Centre, JEM, Westgate, and potential future developments, including the High-Speed Rail between Singapore and Kuala Lumpur, JLD is set to be a major growth region in the years to come.

Summary Highlights:

- The URA has decided not to award the Jurong Lake District master developer site due to the bid price of $640 psf ppr being deemed too low.

- Developers submitted cautious bids in light of high financing costs, long development timelines, and uncertain demand for office space.

- The site will now be placed on the Reserve List, where the government can reassess pricing and market conditions.

- New projects in the Jurong Lake District, such as J'den and The LakeGarden Residences, have shown strong buyer interest with solid sales performances.

- Long-term development of JLD remains a priority, but supply relief is expected in the medium term due to the site delay.

Interpretation of the News:

The URA’s decision reflects a cautious but strategic approach to land sales in uncertain market conditions. While the non-award of the site may seem like a setback, it allows for a more calculated approach to developing the Jurong Lake District over time. Developers are clearly factoring in the long-term risks, and this pause could ultimately benefit the market by preventing oversupply and reducing risk exposure. For buyers, this is a reminder that while the larger developments are delayed, other excellent opportunities in Jurong Lake District still exist, and they are worth exploring before prices rise further.

To stay updated on future developments in Jurong Lake District or other key property markets in Singapore, feel free to reach out! Whether you're an investor looking for growth opportunities or a buyer interested in projects like J’den and The LakeGarden Residences, I can provide insights and help you make informed decisions. Contact me for the latest updates and expert advice.