The real estate market in Singapore has been on a rollercoaster ride in recent years, with property prices reaching new highs and then plateauing. This has led to an increase in the number of homeowners cashing out their properties, as they seek to take advantage of the current market conditions.

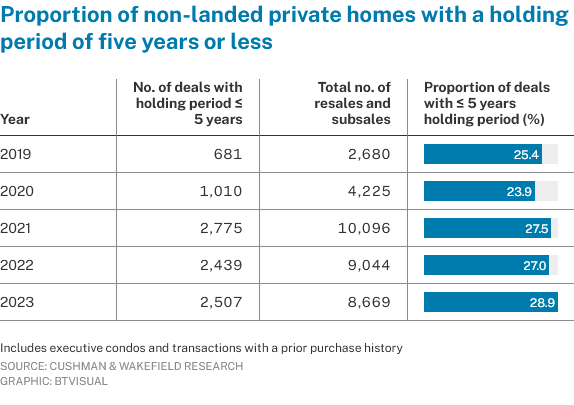

According to data from real estate consultancy Cushman & Wakefield, the total number of deals for non-landed private homes with a holding period of five years or less nearly quadrupled to 2,507 in 2023, from 681 in 2019. The proportion of such deals over all resales and subsales with a prior purchase history also rose to 28.9 per cent in 2023, from 27 per cent in 2022 and 25.4 per cent in 2019.

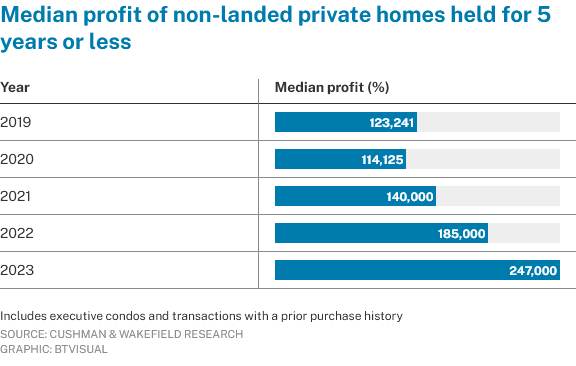

Gross profits reaped on disposal of non-landed units within a five-year holding period also increased. The median profit grew 33.5 per cent to S$247,000 in 2023, from S$185,000 the previous year, and doubled from the S$123,241 recorded in 2019.

This trend is likely to continue in the coming year, as interest rates remain relatively high and rents continue to weaken. However, we could see this trend reverse slightly in 2025, as interest rates come down further and rents start to recover with lower supply expected over 2024 to 2026.

- Total number of deals for non-landed private homes with a holding period of five years or less nearly quadrupled to 2,507 in 2023, from 681 in 2019.

- Proportion of such deals over all resales and subsales with a prior purchase history rose to 28.9 per cent in 2023, from 27 per cent in 2022 and 25.4 per cent in 2019.

- Median profit grew 33.5 per cent to S$247,000 in 2023, from S$185,000 the previous year, and doubled from the S$123,241 recorded in 2019.

- Interest rates remain relatively high and rents continue to weaken, leading to more homeowners cashing out their properties.

The increase in the number of homeowners cashing out their properties is a reflection of the current state of the real estate market in Singapore. With property prices reaching new highs and then plateauing, many homeowners are taking advantage of the current market conditions to sell their properties and cash out their profits.

This trend is likely to continue in the coming year, as interest rates remain relatively high and rents continue to weaken. However, we could see this trend reverse slightly in 2025, as interest rates come down further and rents start to recover with lower supply expected over 2024 to 2026.

If you're a homeowner in Singapore and are considering cashing out your property, now may be a good time to do so. With property prices reaching new highs and then plateauing, you may be able to sell your property for a profit and cash out your profits. However, it's important to consider the current state of the real estate market and consult with a real estate agent to determine the best course of action for your specific situation.

Source: Business Times