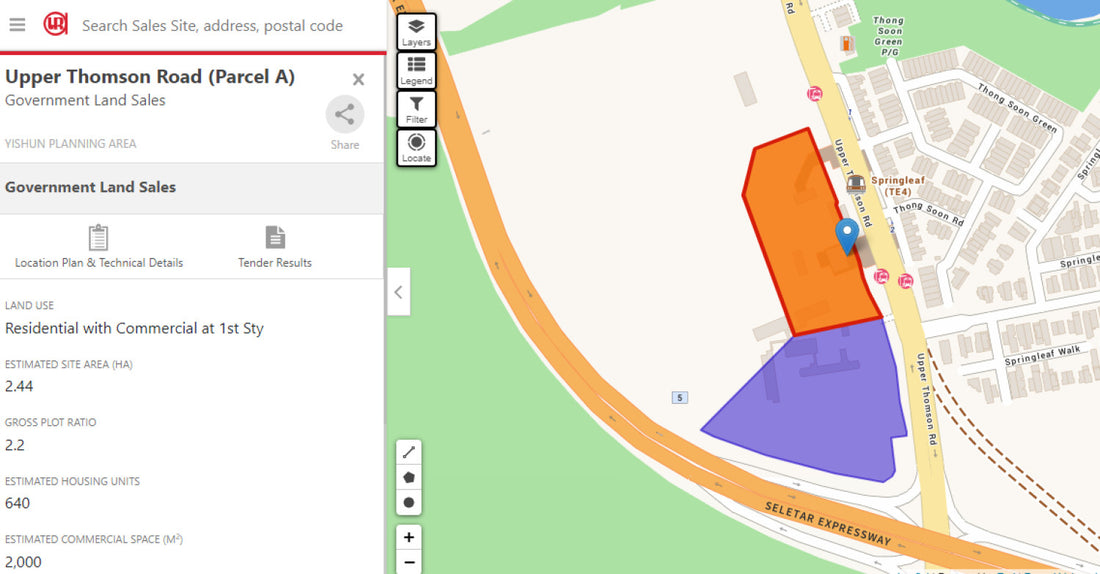

The recent Government Land Sale (GLS) tender for a residential site along Upper Thomson Road closed on June 19 with an unexpected outcome—no bids were submitted. This site, known as Parcel A, spans 262,875 sq ft with a gross plot ratio of 2.2 and is intended to yield up to 640 residential units, including 100 long-stay serviced apartments. This development has raised questions and provided insights into the current sentiments of developers and the future of such sites in Singapore’s property market.

Key Details of the Upper Thomson Road Site

- Location: Upper Thomson Road (Parcel A)

- Site Size: 262,875 sq ft

- Gross Plot Ratio: 2.2

- Potential Yield: Up to 640 residential units, including 100 long-stay serviced apartments

- Commercial Space: 21,528 sq ft

- Leasehold: 99 years

Industry Insights and Expert Opinions

Several industry experts have weighed in on why no bids were submitted for this particular site:

Uncertainty and Unfamiliarity

Mark Yip, CEO of Huttons Asia, noted that the concept of long-stay serviced apartments is relatively untested in the Upper Thomson area. Despite the government reserving only 100 units for long-stay serviced apartments, developers may have perceived the risks as too high and chose to sit out this tender.

Location and Market Demand

Marcus Chu, CEO of ERA Singapore, highlighted that the site is not situated in a key commercial area, which could have supported rental demand. Additionally, Leonard Tay from Knight Frank pointed out that the Upper Thomson/Springleaf area is not typically associated with “mid-term tenants,” which might have further deterred developers.

Competitive Landscape

The developer of Parcel A would also face strong competition from the adjacent Upper Thomson Road (Parcel B) site, recently awarded to a joint venture between GuocoLand and Hong Leong Holdings. This added competitive pressure might have influenced the decision to abstain from bidding.

Future Considerations and Government Actions

Given the lack of interest, Wong Siew Ying from PropNex suggested that the site may reappear in the 2H2024 GLS programme. This could prompt the government to review and possibly revise the requirements for the long-stay serviced apartment component to make such sites more appealing to developers.

Summary and Highlights

- No Bids Submitted: Tender for Upper Thomson Road (Parcel A) site closes with no bids.

- Site Specifications: 262,875 sq ft, 99-year leasehold, potential yield of 640 residential units, including 100 long-stay serviced apartments.

- Industry Opinions: High perceived risk, untested concept for long-stay serviced apartments, and non-prime location deterred bids.

- Competitive Pressure: Adjacent site (Parcel B) already awarded, increasing competition.

- Future Outlook: Potential re-tender in the 2H2024 GLS programme with revised requirements

The lack of bids for the Upper Thomson Road GLS site highlights a cautious approach by developers amid uncertainties and the specific demands of the site. This situation underscores the importance of strategic location and market readiness for new concepts like long-stay serviced apartments. For potential buyers and investors, staying informed about such developments is crucial as they reflect broader market trends and opportunities.

If you are looking to stay updated on the latest developments in Singapore's real estate market, or if you have any questions about upcoming property launches, feel free to reach out to me. Together, we can navigate the evolving landscape and find the best opportunities for you.