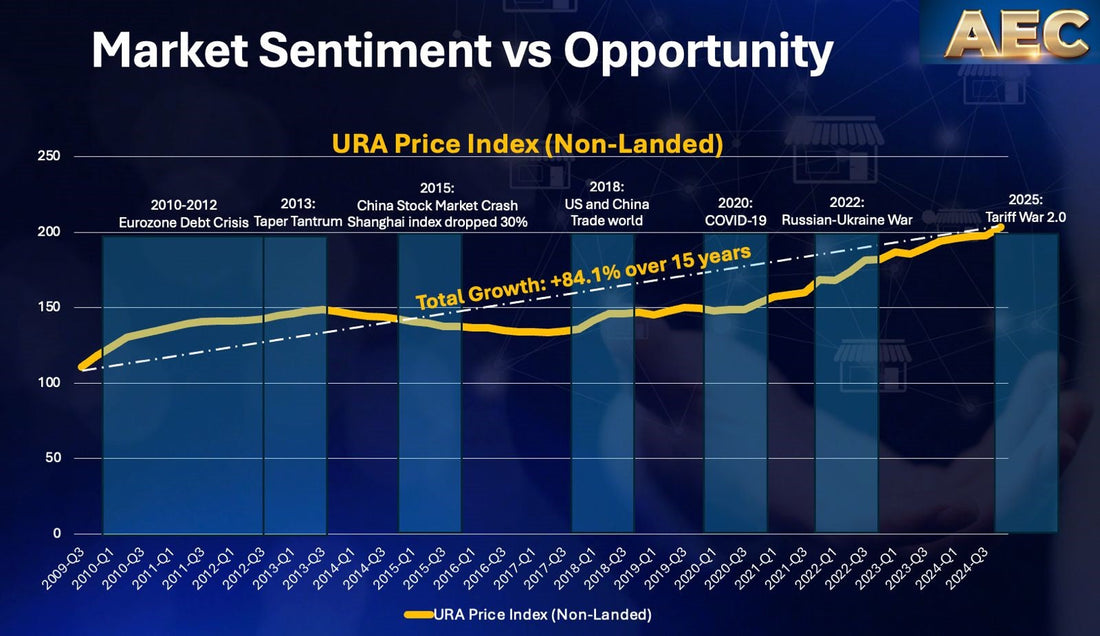

Global financial markets are once again on edge. The fresh wave of tariff tensions in 2025—dubbed “Tariff War 2.0”—has sparked renewed volatility in equities. As fear ripples through the stock markets, savvy investors are shifting quietly, seeking refuge in more resilient, tangible assets.

One place that has stood the test of time?

🏡 Singapore Real Estate — the quiet giant of wealth preservation.

But while panic returns to the stock market, smart money is moving quietly into real estate, especially in stable and resilient markets like Singapore.

📊 Infographic Snapshot: Property vs Market Shocks

7 Major Global Shocks (2010–2022) That Shook Global Equities

-

⚠ Euro Crisis (2010)

-

⚠ Taper Tantrum (2013)

-

⚠ China Crash (2015)

-

⚠ Brexit (2016)

-

⚠ US-China Trade War (2018)

-

⚠ COVID Crash (2020)

-

⚠ Russia-Ukraine War (2022)

And yet...

📈 Singapore non-landed private property prices climbed +84.1% from 2009 to 2024.

💡 Why Property Keeps Winning — Especially in Singapore

1️⃣ Real Estate = Resilience

Singapore’s property market has shown long-term price growth through every major global shock.

2️⃣ Construction Costs Rising

With tariffs driving up material costs, the cost of building new homes will increase, putting upward pressure on future prices.

3️⃣ Capital Chasing Stability

Singapore remains a politically stable haven, attracting high-net-worth individuals from the region looking to preserve capital in property.

4️⃣ Interest Rates May Ease

If rates drop to cushion the economy, property demand will rise — history has shown this repeatedly.

🔍 A Real Case Study: The Class of 2018

Let’s rewind to the 2018 Trade War panic.

-

The S&P 500 fell nearly 19.6%

-

Many investors froze, waiting for the dust to settle

But those who entered the Singapore property market in 2018?

🏠 Enjoyed a ~25% appreciation in property value

💰 Collected ~$480,000 in rental income on a $2M property

📈 Built over $900,000 in total wealth over six years

They didn’t try to time the market.

They simply chose resilience over reaction.

They didn’t try to time the market — they trusted real assets in a real economy.

📘 Get Your Copy: Stock Market Crashing – Survival Playbook

My team and I have put together a concise, high-impact guide for this very moment:

Inside, you’ll find:

-

✅ Global Shocks That Hit Stocks Hard

-

✅ Singapore Real Estate Fundamentals

-

✅ Strategic Positioning in Times of Uncertainty

-

✅ What to Watch in Today’s Market

Reach out to grab a copy now

✅ Key Takeaways

-

✅ Stock markets are volatile — property has been consistently resilient

-

✅ Rising costs will make future homes more expensive

-

✅ Singapore remains a magnet for capital during global uncertainty

-

✅ Smart investors are already positioning for the next rebound

-

✅ Long-term property ownership has outperformed panic selling

📞 Ready to Explore Resilient Opportunities?

Now is the time to position yourself before the rebound.

Reach out to receive your free copy of the “Stock Market Crashing – Survival Playbook”, and let’s have a chat about undervalued gems in today’s property market.

Don’t just ride out the storm — invest through it.