On May 14, the Urban Redevelopment Authority (URA) tendered a prime 99-year leasehold private housing site near Holland Village MRT station, attracting three bids. Leading the charge was a consortium headed by UOL Group and CapitaLand Development, placing a top bid of S$805.39 million, equivalent to approximately S$1,285 per square foot per plot ratio (psf ppr). This tender marks a noteworthy moment in Singapore's real estate landscape, reflecting current market sentiments and future expectations.

Summary of Key Highlights:

- Top Bid: S$805.39 million (S$1,285 psf ppr) by a consortium led by UOL Group and CapitaLand Development.

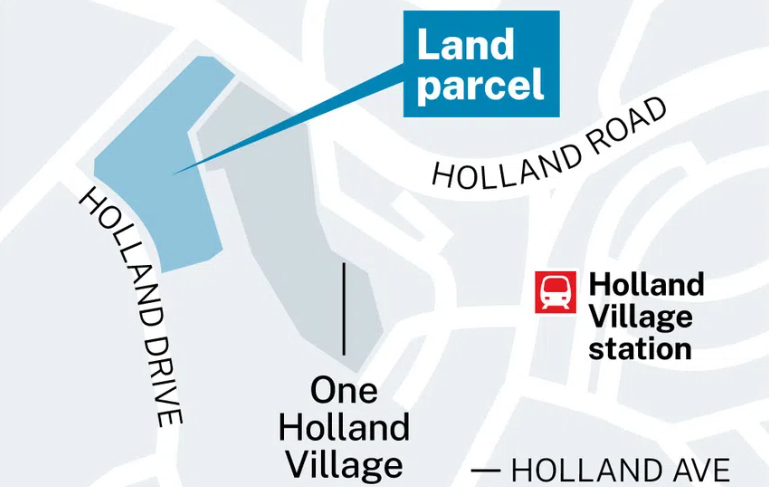

- Site Details: 99-year leasehold, near Holland Village MRT, capable of housing approximately 680 units.

- Bids Received: Three bids, with the highest significantly below market expectations.

- Comparison: The top bid is 32% below the S$1,888 psf ppr fetched in 2018 for the adjacent One Holland Village site.

- Developer Caution: Reflects conservative bidding amid market uncertainties.

- Future Development: Plans include two 40-storey condominium towers accommodating 680 units.

- Market Analysis: Estimated selling price starting from S$2,800 psf.

The tender results for the Holland Drive site reveal several critical insights into Singapore's real estate market. The top bid, though substantial, was below the S$1,350 to S$1,500 psf ppr range that analysts had predicted. This caution underscores developers' careful approach to large, prime sites amid current market conditions and recent policy changes.

The conservative bids can be attributed to several factors:

- Market Conditions: The property market is still adjusting to the cooling measures implemented in April 2023, which included higher Additional Buyer's Stamp Duty (ABSD) rates, affecting foreign buyers and investors.

- Development Risks: The larger size of the Holland Drive site, capable of yielding 680 units, presents higher developmental risks. Developers are wary of potential challenges in selling such a substantial number of units in a competitive market.

- Location Dynamics: While Holland Village remains a highly desirable location, its proximity to other significant developments, like One Holland Village, influences market perceptions and price expectations.

Despite these cautious bids, the consortium led by UOL and CapitaLand remains confident in the site's potential. The planned development of two 40-storey condominium towers promises to add to the vibrant residential landscape of Holland Village, appealing to both local and expatriate communities. The excellent location, near the MRT station and established amenities, ensures strong market interest.

For prospective buyers and investors, understanding these market dynamics is crucial. The Holland Drive site's development represents an exciting opportunity in a prime location, with competitive pricing expected to attract discerning homebuyers. To stay updated on this and other significant real estate developments, reach out to us for expert insights and guidance. Our team is dedicated to helping you navigate Singapore's property market effectively, ensuring you make informed and strategic decisions.