The Urban Redevelopment Authority (URA) has launched the Zion Road (Parcel B) site for tender, marking the first Reserve List site activation since 2018. This 99,953 sq ft site, zoned for residential use, is poised to house approximately 610 units, offering a prime opportunity for developers. Here’s a comprehensive look at the key aspects of this tender and its implications for the property market.

Summary of Key Highlights:

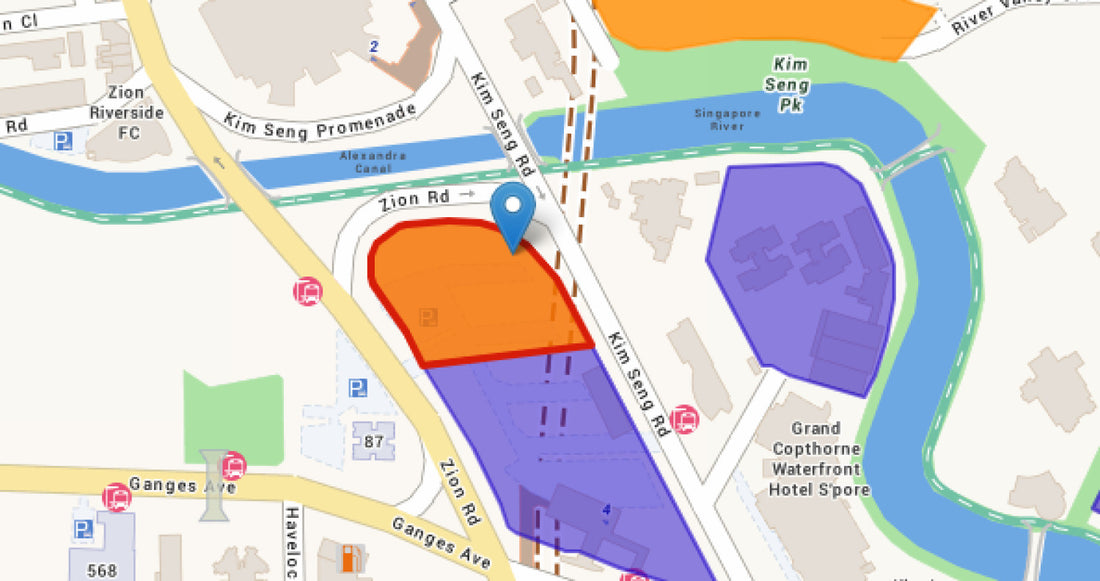

- Site Details: Zion Road (Parcel B) spans approximately 99,953 sq ft and is zoned for residential development.

- Unit Potential: The site can accommodate around 610 residential units.

- Reserve List Activation: This is the first Reserve List site to be triggered since 2018.

- Developer Interest: An undisclosed developer initiated the tender with a committed minimum bid of $604.57 million, equating to about $1,080 psf per plot ratio (ppr).

- Comparative Benchmark: The adjacent Zion Road (Parcel A) was awarded to a City Developments Ltd (CDL)-Mitsui Fudosan joint venture at $1,202 psf ppr.

- Bidding Expectations: Experts anticipate competitive bids for Parcel B to range between $1,100 and $1,200 psf ppr.

- Proximity to Amenities: The site benefits from its proximity to Great World City mall, Zion Road food centre, Havelock and Great World MRT stations, and River Valley Primary School.

- Market Considerations: Developers are expected to proceed with caution due to the substantial upcoming supply of private housing in the vicinity.

The launch of Zion Road (Parcel B) signifies a significant moment in Singapore’s property market, reflecting renewed confidence among developers in strategic urban locations. The proximity to key amenities and the central business district (CBD) makes this site particularly attractive. However, the considerable upcoming supply of private housing in the surrounding area, including units from the adjacent Parcel A and River Valley Green Parcel A, necessitates a strategic approach to bidding.

The activation of this Reserve List site also indicates a potential shift in developer sentiment, with a willingness to invest in prime locations despite broader market uncertainties. The anticipated bid range of $1,100 to $1,200 psf ppr suggests a cautious yet optimistic outlook, balancing potential risks with the site's inherent advantages.

Stay informed and ahead of the market trends by connecting with real estate experts. Whether you are an investor, a potential homeowner, or a developer, understanding the nuances of these developments is crucial. Reach out to us for detailed insights, strategic advice, and to keep abreast of the latest updates on the Zion Road (Parcel B) tender and other significant property market movements.